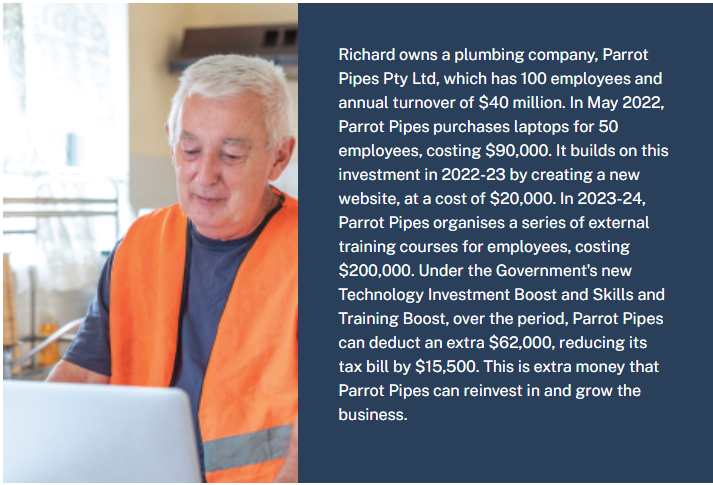

On March 29 2022, the Morrison Government announced it will support Australian small businesses and encourage them to invest in digital technology, skills and training. The new measures are subject to decisions from the new Government.

Small Business Technology Investment Boost

The boosts are for eligible businesses that have less than $50 million in annual turnovers. Suitable businesses can claim eligible tech spending, of up to $100,000, until June 30 2023, in their 2022-23 tax return.

Small Business Skills & Training Boost

The Skills and Training Boosts will give small businesses access to a further 20% deduction on eligible external training courses for upskilling their employees. The Skills and Training Boost will apply to costs incurred from March 2022 until 30th June 2024, delivering $550 million in tax relief.

What can be claimed?

Claim on expenditures and depreciating assets that support digital uptake. Budget documents suggest SMEs will be free to claim the cost of

- Portable payment devices

- Cyber security systems

- Web design

- Subscriptions to cloud-based services

- New laptops

- Training courses delivered by entities registered in Australia